do dealerships ask for proof of income

This will increase the likelihood of getting approved for an auto loan. Theyll verify whether the pay stubs are real or fake before you proceed.

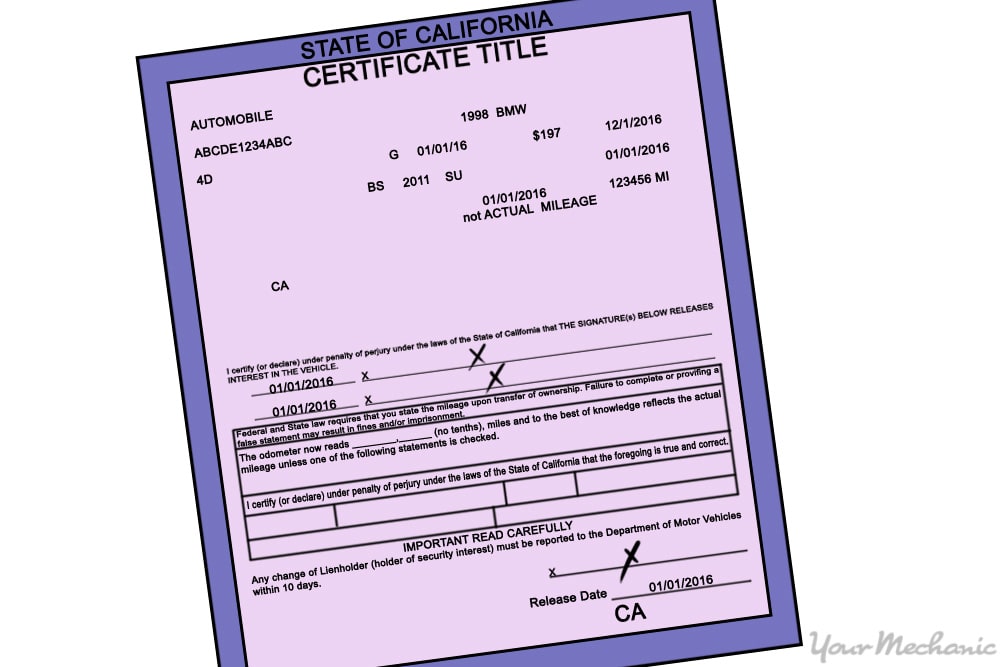

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Although you may be asked for it just out of habit from either the salesperson or the finance team.

. Ive bought a many of vehicles without ever having to show proof of income. Credit and banking history. Keep the loan amount small relative to your incomeexisting debt.

May 7 2021 by Kevin Haney. When the economy was good it was hard to get a motorcycle loan now it is really hard. If your credit score isnt the best they require hard proof that youre able to take on a bad credit car loan.

A dealership asking for pay stubs is a standard part of the auto loan application process. But if you have a non-traditional source of income or the bank has difficulty getting information from your employer the. As such you need to present your pay stubs.

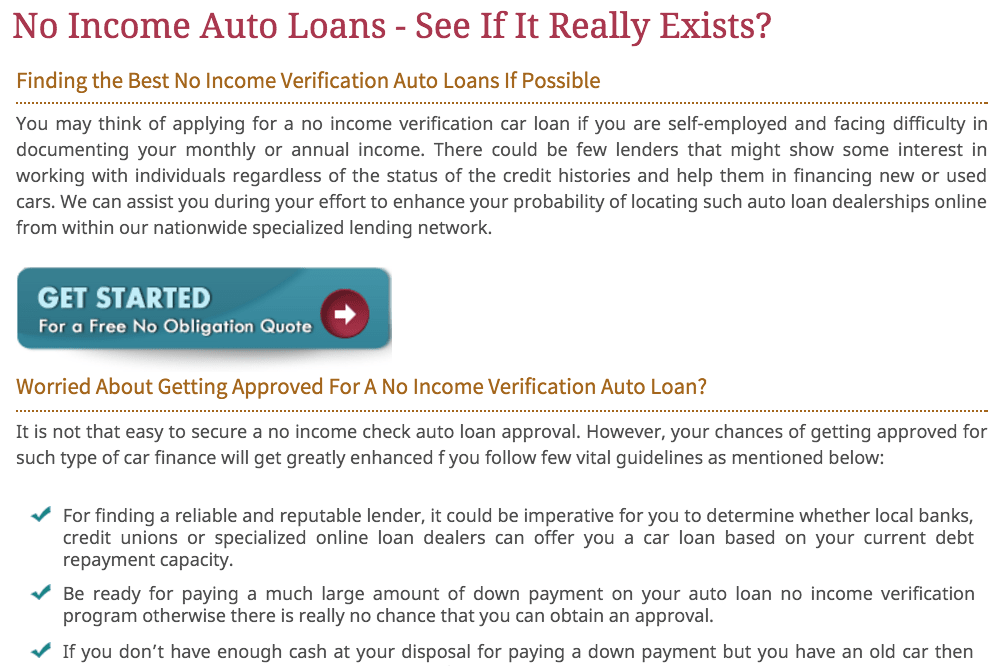

The lender or dealer will need at least that value lost to finance the car without verification of your income. When and why do auto lenders verify your income and employment. Read on if you want to know more about the entire income verification process.

Plan to pay 20 percent down or more to reduce the lenders risk and increase your chances of getting the loan. If you are shopping around for a new car you may find it helpful to know when and why auto lenders verify income and employment. Method 1 of 5.

If you have bad credit the lender will ask for proof of income and will have a minimum income requirement you must meet generally 1500 to 2000 a month pre-tax. You can apply for financing elsewhere and use the dealer as a last resort for financing if you prefer. But when your credit isnt great subprime lenders use you your income to help determine what you qualify for.

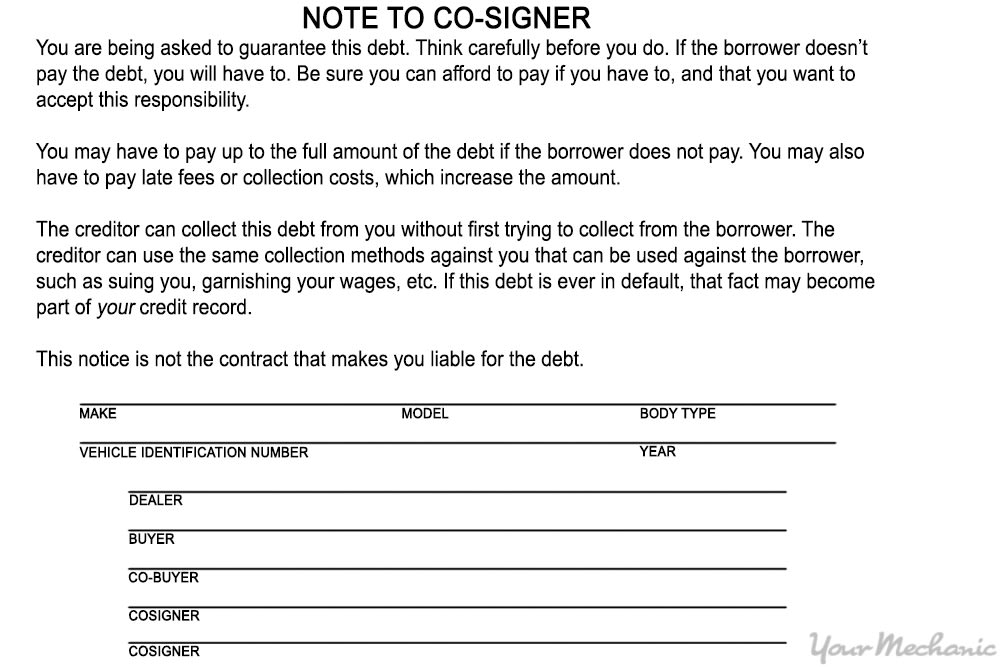

However it is still possible to buy a car even if you dont have proof of income when you follow some specific steps. If you dont want to give the bank what they want then take the car back. The second way you can prove your income is by providing bank statements and tax returns.

Although the minimum income requirement varies by lender they typically want to see you make anywhere from 1500 to 2000 a month before taxes. Your bank credit union car dealer or finance company may contact your employer and or ask for proof of income documentation for marginal applications if they cannot do so electronically via an. This is to make sure youre able to make the monthly payments.

Showing proof of additional sources of income or other assets may help you to qualify for a larger loan or improve the terms of your loan. All documents must be dated within 15 days of purchase unless otherwise noted below. When talking with a local car dealer you should ask about its income requirements before applying for a loan.

So before you head to the dealership make sure you bring a paystub or bank statement. The bank isnt satisfied with your proof of income. If you do not have a proof of income prepare several months ahead of time to improve your credit score.

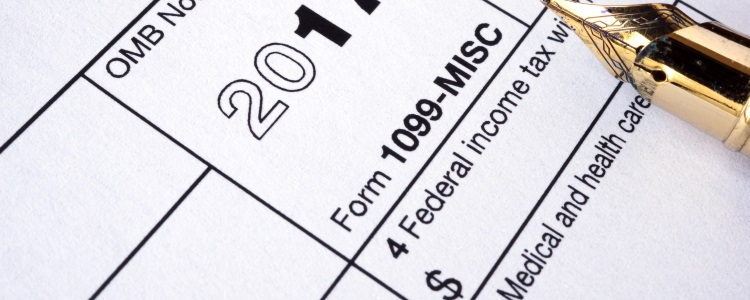

If you get handwritten checks or your check stubs dont include year-to-date income information you typically cant use them. Your bank credit union car dealer or finance company may want to substantiate both income and employment for marginal applications. If you have good credit lenders arent going to ask for proof of income most of the time.

In regards to paying cash any cash transaction over 10000 dollars requires an IRS 8300 Form. If you have income from rentals legal settlements alimony child support Social Security or other sources take proof with you. Therefore youll need to make sure you have some recent stubs to provide to the lender.

The dealership doesnt care about your tax returns the bank is requesting them. Now I would have to question what your family member listed on the credit application. It doesnt mean youre approved but it means a lender is interested enough to keep the process going rather than simply declining you.

In most cases they need to ask for your proof of income to ensure that you have the capability to handle your proposed car loan. 08 Vegas Low x 2 Vegas LE 001 Cross Roads LE 001 High Ball Vegas 8-Ball Cross Country Vision Cross Roads. This is what you need to bring to show proof of income when taking out a bad credit auto loan.

Approved for credit is step 1. In short no you do not have to provide proof of income. No game they just want your pay stubs to reflect your stated income and they want proof that you live where you say you live so youre not falsely stating your living arrangement.

Most of those if not all does ask about income and employment info. For most W-2 employees banks verify income for auto loans quickly and smoothly. This can vary but 20 of the cars purchasing price is a good benchmark.

Verifying your income is another process entirely. Proof of income. If you are unable to provide that evidence because you dont have a job or are self-employed your options are somewhat limited.

When you purchase a car with vehicle financing providing proof of income is a must. Subprime lenders need proof of income in the form of computer-generated check stubs or proof of income with tax returns andor bank statements if you have anything other than W-2 income. Lenders typically ask for your most recent monthly check stubs though the specific number required varies by lender.

6 X Research source 7 X Trustworthy Source Federal Trade Commission Website with up-to-date information for consumers from the Federal Trade Commisson Go to source. Because auto lenders want to verify that you have a steady income to pay back the car loan or auto financing over time. If you have excellent credit you may not need to show proof of income but there are sometimes exceptions to that.

Choose the category that best represents your primary source of income. Up to 8 cash back When you apply for a car loan most lenders require proof of income. The first step a lender might take is asking for your pay stubs.

Type of Motorcycle Currently Riding. However if a dealer is asking for proof of income you may have an issue with your debt-to-income ratio which is the amount of debts you pay each month in comparison to the amount of money you claim to make. Marginal applications have a combination of lower credit scores higher purchase prices or low down payments.

This helps us verify your information so you can drive home the car you love the same day. But if you dont provide proof of income or employment verification the lender may want to see that you have a good credit history or view a bank statement or other records to show that you have the money needed to repay your debt. Requirements vary by type of income.

They want to confirm whether your monthly earnings are. To answer your question yes a dealer can sell a vehicle to someone without proof of income. I dont think anyone would do it without income.

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

What Documents To Bring When Buying Or Leasing A Vehicle Schlossmann Honda City

Proving You Have Cash Income 500 Below Cars

Heavy Truck Financing New Trucks Heavy Truck Trucks

With So Many People Searching For Healthier Products A Healthier Lifestyle It S No Wonder Arbonne Is Becoming More And More Direct Sales Plexus Products Job

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

What Can Be Used As Proof Of Income For A Car Loan

Documents To Bring When Buying A Car Haus Auto Group

I Don T Have Check Stubs To Prove My Income For An Auto Loan Auto Credit Express

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

Do You Need Proof Of Income To Buy A Car Sane Driver

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

What Can Be Used As Proof Of Income Auto Credit Express

Acceptable Proof Of Income For Car Loans In Port Credit Car Nation Direct Car Nation Direct

Dyazo Com In 2022 How To Memorize Things Positivity Words

3 Auto Loans Without Proof Of Income Required 2022 Badcredit Org

Dyazo Com In 2022 How To Memorize Things Positivity Words

How To Buy A Car When You Don T Have Proof Of Income Yourmechanic Advice

What Can Be Used To Show Proof Of Income For A Car 500belowcars Com