open end mortgage vs heloc

Best for Online Service. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

. First Time Home Buyer. Ad 2022s Best Home Equity Loans. Find The Best HELOC Mortgage Rates.

If the loan is for consumer purposes and secured by a dwelling of the consumers it does not even need to be a primary residence it is a HELOC and governed. Home equity line of credit. This is called the draw period.

Tap Into Your Homes Equity Without A HELOC. Use Your Home Equity Get a Loan With Low Interest Rates. Borrowers with open-end mortgages can return to the.

Draw period limitations Open-end mortgages may only allow you to take additional distributions during a limited time. The main difference between a home equity line of credit and a HELOC concerns the way you receive. Ad We Offer The Competitive Mortgage Rates You Want And The Superior Service You Deserve.

Unlike a mortgage both open- and closed-ended home equity loans are low-fee transactions. When you take out a HELOC you receive a maximum line of credit that you may access. Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders.

Ad Call to find out more. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals. Which Option Is Right For You.

Special Offers Just a Click Away. Get Current Residential Mortgage Rates From Us. A home equity loan is often called a second mortgage because it follows behind your first mortgage.

Unlike other mortgages the HELOC functions like a credit card. A home equity loan uses your home as collateral. It is important to understand that the open-end threshold and reporting requirement does not apply only to HELOCs.

Differences and Similarities Between a Home Equity Loan and a HELOC. Open-end dwelling secured consumer lines that. An open-end mortgage is one that allows the borrower to increase the amount of mortgage principal owed at a later date.

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. Meaning your mortgage balance and any existing home equity loans total no more than 80 percent of your home. Open search Close search.

Choose an open-ended loan when you require a constantly available line of credit for ongoing expenses. You will pay an application fee on either but the lender will often pay most or all of the closing. Top 5 Best Home Equity Lenders.

Use Our Comparison Site Find Out Which Lender Suits You Best. Ad Fast Home Loan Application. A HELOC is meant to be a more flexible loan so there will be a.

Professional Responsive Mortgage Lenders. An open-end mortgage functions similarly to a mix of a standard mortgage and a HELOC except that you just need to apply once rather than attaching a second lien to your. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Home-equity line-of-credit HELOC rate from a Big Five bank 445. Therefore taking a HECM at 62 gives your line of credit time to grow as opposed to waiting until 82 especially if the expected. However open-end mortgages are a less common type of.

And once the draw. A second mortgage is paid out in one lump sum at the beginning. Skip The Bank Save.

The annual interest cost on a 300000 mortgage with a 25-year amortization using the rates above is as. The primary difference between a HELOC and a home equity loan is the way that you access and repay the funds. Home Equity Loan vs.

Top Lenders Reviewed By Industry Experts. An open-end mortgage works like a hybrid between a traditional mortgage and a HELOC except you only have to apply once instead of adding a second lien to your home. Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a property is purchased.

Pay for college tuition with an open-ended loan or for long-term medical care. Citi offers a streamlined online experience. Were Committed To Giving You The Mortgage Solution You Need To Achieve Your Goals.

The unused line of credit grows at current expected interest rates. Ad Use Lendstart Marketplace To Find The Best Option For You. The banks Citi Mortgage Selector tool will give you an idea of what your loan will cost.

The terms are usually. A second mortgage and a home equity line of credit HELOC both use your home as collateral.

Open Vs Closed Mortgage What S The Difference Lowestrates Ca

Open End Mortgages A Comprehensive Guide Smartasset

What Is Open End Credit Experian

Moving Past The Mortgage How Startups Are Shifting Home Financing From Debt To Equity Home Equity Line Of Credit Refinancing Mortgage

Open End Mortgage Loan What Is It And How It Works

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Credit Union

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

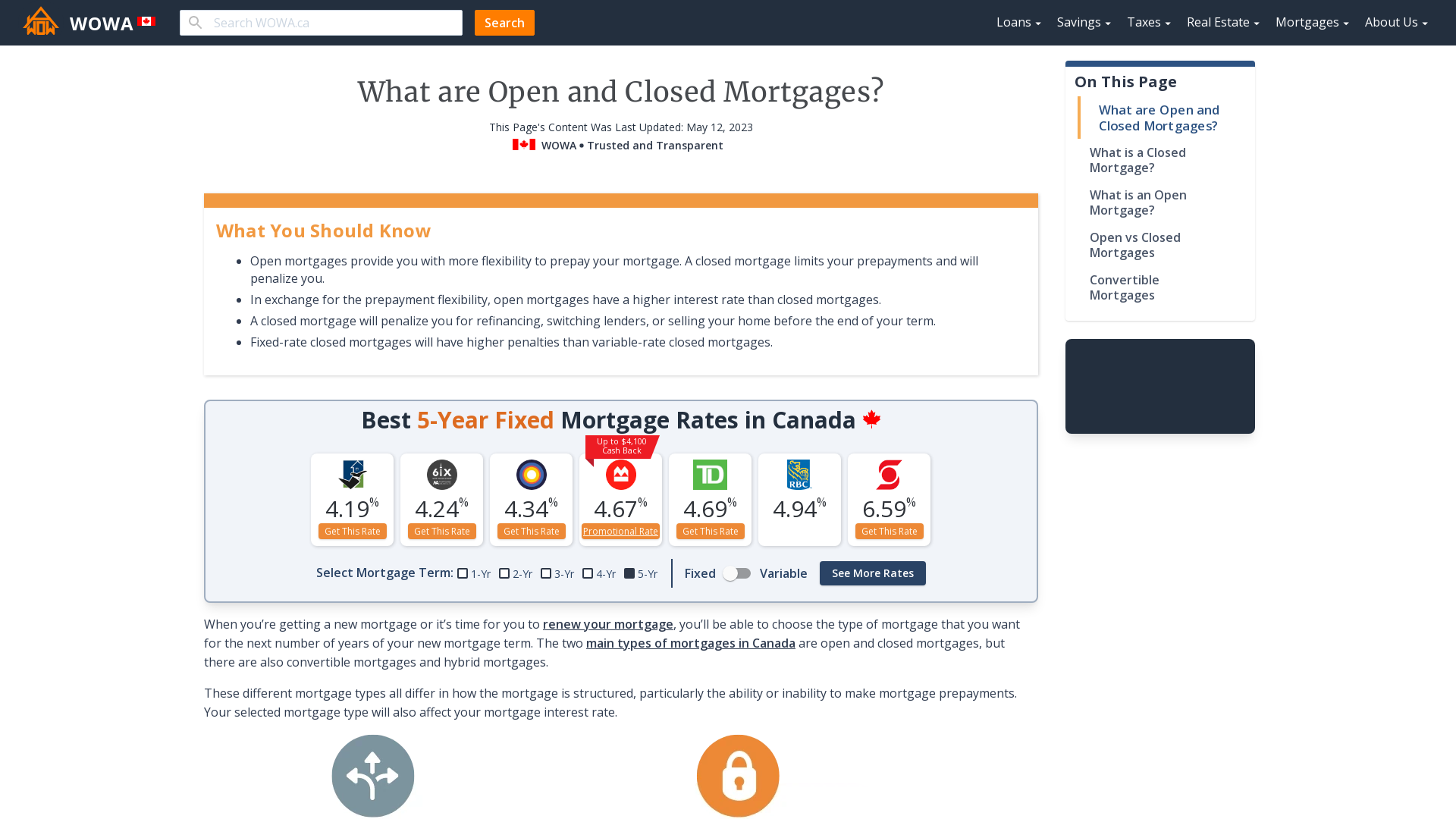

Differences Between Open Closed Mortgages Wowa Ca

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Open End Mortgage Loan What Is It And How It Works

Home Equity Loan Vs Home Equity Line Of Credit Hel Vs Heloc Choosing A Home Equity Loan Articles Home Equity Loan Refinance Mortgage Home Equity

Home Equity Oak Tree Business Home Equity Equity Mortgage Loans

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)